Community Collaborative Day 1

An intro to Conroe ISD, including the exciting topics of finance and procurement!

As part of the Conroe ISD Community Collaborative program, around 30 district residents, including myself, are learning about how things work within our school system. It is an inside, behind-the-curtain view of all the (incredibly boring) aspects of how schools are run.

I say “boring” in jest, because I know topics like finance and procurement may seem mundane for most. Yet, similar to any large company, schools have massive operations for things like maintaining buildings, paying the bills, or delivering 4,000,000 milk cartons every year. If you add in overly complex government regulations based on outdated policies and shoestring budgets, it is a wonder that large districts are able to manage as well as they do.

The Collab program is a first of its kind for the district, orchestrated by an exceptional communications team. It includes a variety of district residents, from everyday parents to PTO Presidents, booster club members, Watch DOGS, and all five hopefuls running for the Conroe ISD Board election this November.

The format for the first day was fairly simple. Everyone introduced themselves and how they are connected to the district, and the district directors gave their 30-second elevator speeches.

After intros, Dr. Null, Superintendent, provided the introduction to the district, which was then followed by a Finance 101 presentation by the new Chief Financial Officer, Karen Garza. We ended with a deep dive into Procurement from Rick Reeves, the Director of Procurement & Business Services.

We were able to ask questions and had a few interesting discussions. I took several notes for the three and half hours we were there.

All of the presentation content can be found here.

Introduction

Dr. Null provided all the basic info for the district, including what the district encompasses such as the 73,000 students, 9,000+ employees, 1000+ substitutes, all spread across 70 campuses. Conroe ISD is bigger than Boston and San Francisco Public Schools, being the 9th largest district in Texas and 60th in the nation (out of 13,000!).

He also touted all the awards that CISD has won, including the most recent award for being #37 in the Forbes 2024 Best Large Employers. Only one other school district made it into this list, and CISD was ahead of companies like Chevron, Dell, and other big names.

I may follow up on how this award was given, as it was done through the Houston Chronicle and employee surveys.

I do smile somewhat when I see some of these awards. Being the best in Montgomery County doesn’t say too much when you are the largest school district and employer in the County by a factor of five. But Niche and Forbes awards are certainly great accomplishments.

Other info noted was that Conroe was been named the fastest growing city in the United States, and The Woodlands has been named one of the best places to live in the United States. Naturally, people are moving here, and CISD has a huge need to accommodate all of the recent growth.

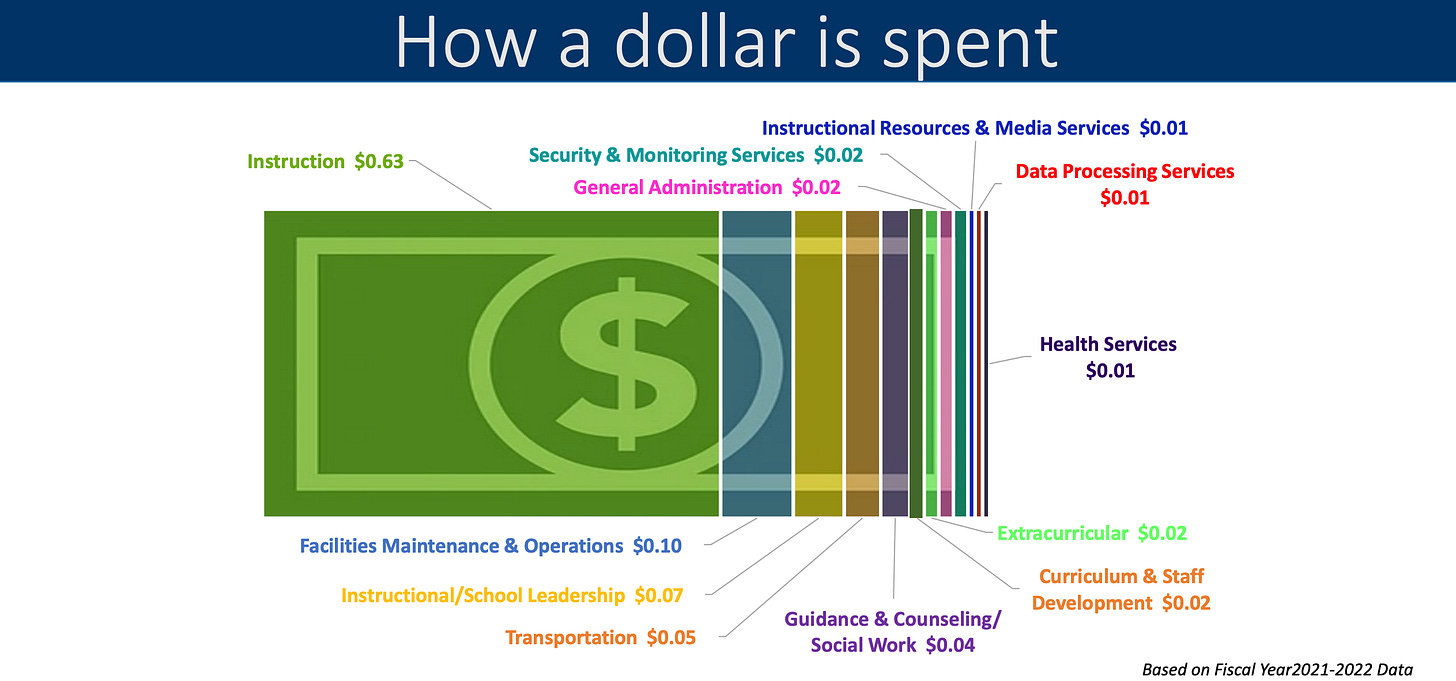

The key factors for the district is that it runs lean, with the smallest tax rate compared to peer districts, and yet continues to maintain in the top two districts for student achievement (based on STAAR testing). We do more with less, apparently.

Finance 101

Public finance can be difficult to understand for someone who has never dealt with public budgets. I sit on a MUD Board, where we work on similar tasks like managing the M&O and Debt, setting tax rates and exemptions, maintaining services, etc.

School districts have the same tasks, except they must do so while running half-blind through an obstacle course that doubles as a mine field.

Public school financing in Texas is quite complicated and based on outdated State policies (in my opinion). We would need to deep dive school finance in a separate post, but we are going to attempt to break it down in a few key points.

Texas schools are funded by local taxes and the State:

State funding is based on how many kids attend school per day, a.k.a., Average Daily Attendance (ADA), among other things.

Local tax rates are set by the School Board and paid for by us, the taxpayers.

State Funding

Texas funds schools with a per student allotment of $6,160 per year, which hasn’t been adjusted since 2019 (!!). In order to calculate how many students a district has, the State does not use a basic enrollment count, because that would be too easy. It uses a variety of things, including the Average Daily Attendance (ADA), enrollment, special needs students, and other factors. We will stick with ADA alone to keep it simple for now.

The ADA is defined as the following:

ADA is the number of students in average daily attendance, or the sum of attendance for each day of the minimum number of days of instruction as described under the TEC, §25.081(a), divided by the minimum number of days of instruction.

ADA = Sum of Attendance Counts ÷ Days of Instruction

Texas is one of six states in the U.S. that calculates school funding on Average Daily Attendance, rather than total enrollment or other methods. Without getting into the weeds on ADA or Weighted ADA, we should know that this method makes it difficult for schools to plan ahead. How do you plan a budget for an entire year when you have to estimate what your student daily attendance is going to be?

For the example in the image above, for 1,000 students who count towards ADA, multiplied by the basic allotment per student of $6,160, this is what this school would get from the State.

The State has a ‘true-up’ of daily attendance mid-year, but it still defeats the purpose of setting proactive budgets based on expected needs. The district and Board are basically playing a guessing game every year for what the total state entitlement will be, which is especially difficult in a growing district like Conroe ISD.

Luckily for the Board, the Finance team is on point.

Local Taxes

School districts set their tax rates each year, one for M&O (Maintenance & Operations), and one for Debt. To keep it brief, M&O keeps the lights on and the teachers paid. Debt builds the new schools, which is funded through bonds.

The tax rates for M&O and Debt are combined together, and is what you are billed for in your property taxes, minus any exemptions like the Homestead Exemption, Disabled Veteran Exemption, etc.

The major downside to school taxes is that unlike cities or municipalities, any extra funds generated through local taxes does not go to the school district. It goes to the State. It doesn’t matter if the School Board raises the tax rate to pay for teacher raises, because any extra funding generated is then decreased from the State’s share. The budget remains the same.

Mind you, the district certainly can increase budget to pay staff more, but without extra State funding it then dips into a deficit budget, which like many other school districts in Texas, Conroe ISD recently adopted. You can thank your Texas State reps for that.

If you are a homeowner, you should (hopefully) know that your tax amount is based on your property value, which since 2020 has increased considerably every year. As your property value goes up, your taxes go up with it. It is why you should protest your property values every year.

This also means the certified property value for the school district has gone up significantly in the last few years, from $40 Billion to $55 Billion between 2020 and 2023!

For schools, this means that in order to keep the same amount of State funding, it must lower its tax rate to receive the same tax funded amount as before. Essentially, school districts are forced to continue lowering tax rates every year if property value goes up. This may sound great to your small government champion, but you should know how much this really hampers a school’s ability to serve students.

Texas offers programs to offset certain costs, such as different types of allotments (i.e. funding). There is also another Tier of funding, where you will hear words like ‘golden pennies’ and VATREs, but your eyes are probably already glazed over.

Slap State funding and local taxes together, along with any allotments or other special funding, and you get your school district income to use for the budget.

Karen Garza’s presentation was as simple as it could get, and it still left me with so many questions. Give it a scroll.

Financing is COMPLEX for school districts. Board members need to be well-trained in how these things work, so that they can make the best decisions for the school district and its students.

Procurement

Even Rick Reeves, Director of Procurement, admitted how boring procurement was, but he certainly knows his stuff! Rick has an impressive resume; so much so that I’m amazed he is working in the public sector.

Similar to finance, public school procurement appears equally as complex.

We walked through the purchasing process, how bids are done, purchasing law, how contracts are awarded, cooperatives, awarded vendors, as well as their new e-procurement platform to help simplify the process.

I am still reviewing Rick’s slide deck, so I have not gone as deep as I did for finance. What I can say is that Conroe ISD certainly has some impressive people working within it, both in the classroom and behind the desk.

Next Up

These Collab meetings are spread out across the Spring semester, with five in total. We will be visiting various places around the district, including schools, viewing construction underway, the transportation barn, and other places where we can learn the ins-and-outs of Conroe ISD.

The next update will be posted after our next meeting.

Thanks for reading!

Collab Meeting Summaries:

Meeting 1: Intro to Conroe ISD, Finance, Procurement

Meeting 2: Growth & Transportation

Meeting 3: Staff Development, Recruitment, Retention

Meeting 4: CTE, SPED, Extracurriculars, Zoning

Meeting 5: Planning & Construction, School Safety, Summer School